Introduction

An organization may finalize its business plans following the advice of demand forecasts. Once the business plans are in place and approved, the company can perform reverse work from the last sales unit to the raw material needed. So, the quarterly and annual plans are divided into raw material, labor working capital. Medium-range time duration is 6 months to a period of 18 months. This method of determining production requirements over medium-range planning is known as aggregate planning.

Factors that affect aggregate planning

Planning for aggregates is an operation essential to the company as it seeks to balance long-term strategic plans with the short-term success of production. These are the factors to consider before the process of aggregate planning being able to begin.

Complete information is needed regarding the production facility available and raw materials. Planning financials for the cost of production that comprises labor, raw materials, and inventory planning.

Organization policies on the management of quality, labor management, and so on. For the aggregate plan to be successful, three elements must consider:

A forecast of the aggregate demand for the pertinent time.

Evaluation of all possible options to manage capacity planning including outsourcing, sub-contracting, etc.

The current operational status of the workforce (number of employees, skills set, etc.) as well as inventory levels and productivity efficiency

Aggregate planning ensures that a company can plan for the inventory, workforce size, and production rate in keeping with its strategic aim and mission.

Aggregate planning as an operational Tool

Aggregate planning is a way to ensure that there is a balance between the operation goals, financial goals, and the overall goal of the company. It acts as a platform to manage demand and capacity plans.

So, if demand isn’t meeting the capacity of an organization. Hence, it can attempt to achieve a balance by promotion, pricing, order management, and even new demand creation.

If capacity isn’t meeting demand, the organization could attempt to balance both through various strategies, including.

Inadequate or excess workforce until demand declines/increases. Including overtime in the scheduling will result in creating more capacity. Hence employing temporary workers for a fixed period or outsourcing the work to a subcontractor.

Importance of Aggregate Plan

Aggregate planning plays a crucial role in achieving the long-term goals of an organization. Aggregate planning assists in the following ways:

Financial goals can be achieve by decreasing the overall variable cost and enhancing the bottom line.

The maximum utilization of the production facility

Give customers a great experience by matching the demand and decreasing wait times for customers

Reduce the investment in stocking inventory

Able to meet schedule goals and create a healthy and happy workforce

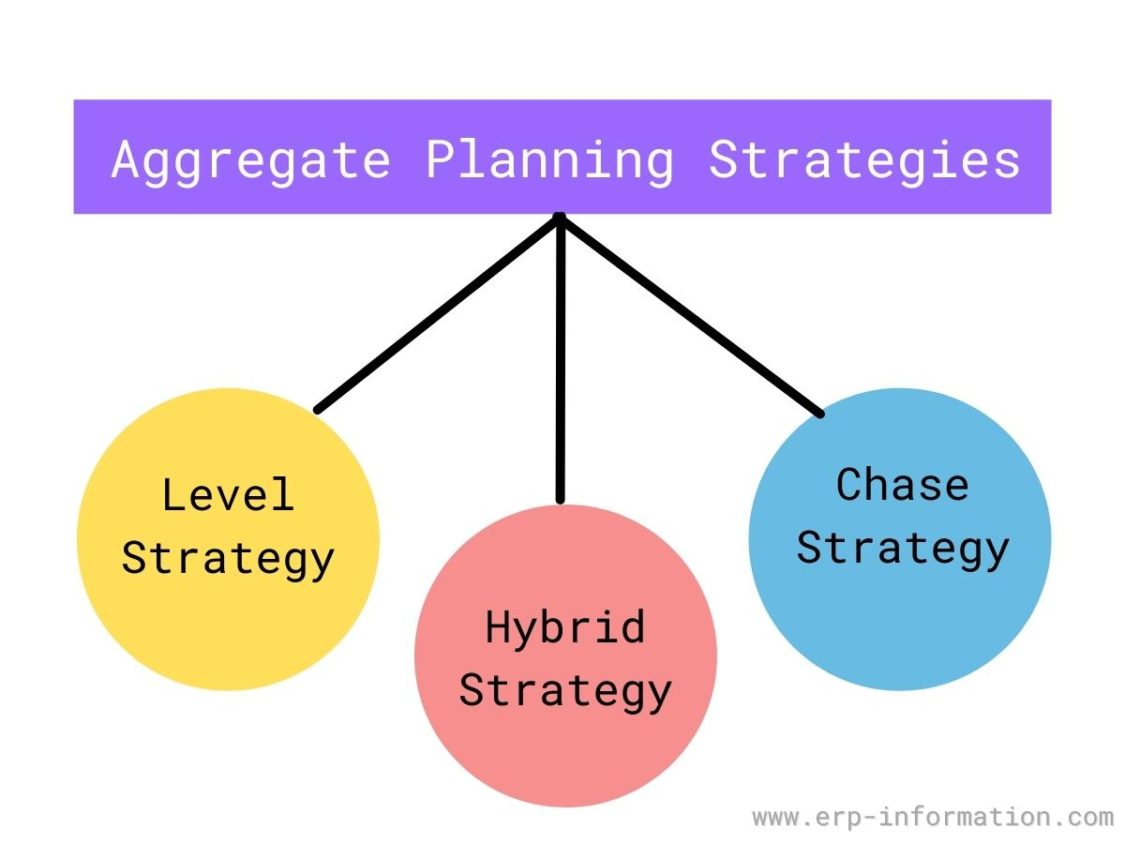

Aggregate Strategies

There are three kinds of planning strategies that are aggregate for companies to pick from. They are like this.

Level Strategy

As the name suggests the level strategy aims at maintaining a consistent productivity rate and worker level. Hence, this strategy requires a thorough forecast of demand to increase or reduce production to meet the demand of customers being higher or lower. Thus the benefits of this strategy are steady staff. A disadvantage of the level strategy is that it can increase inventory and a rise backlogs.

Chase Strategy

As the name implies, the chase strategy is design to meet demand and production. The advantage of the chase strategy is the lower level of inventory and backlogs. So, its disadvantage is less productivity, quality, and a lower workforce.

Hybrid Strategy

The name implies the hybrid strategy seeks at balancing strategies of level and chase.